The Estate, Legacy and Long-Term Care Planning Center of Western NY

Financial Advisor in Rochester, NY

Biden Hits the Campaign Trail With Tax Policy Proposals

It’s never too early for clients to prepare for potential tax changes.

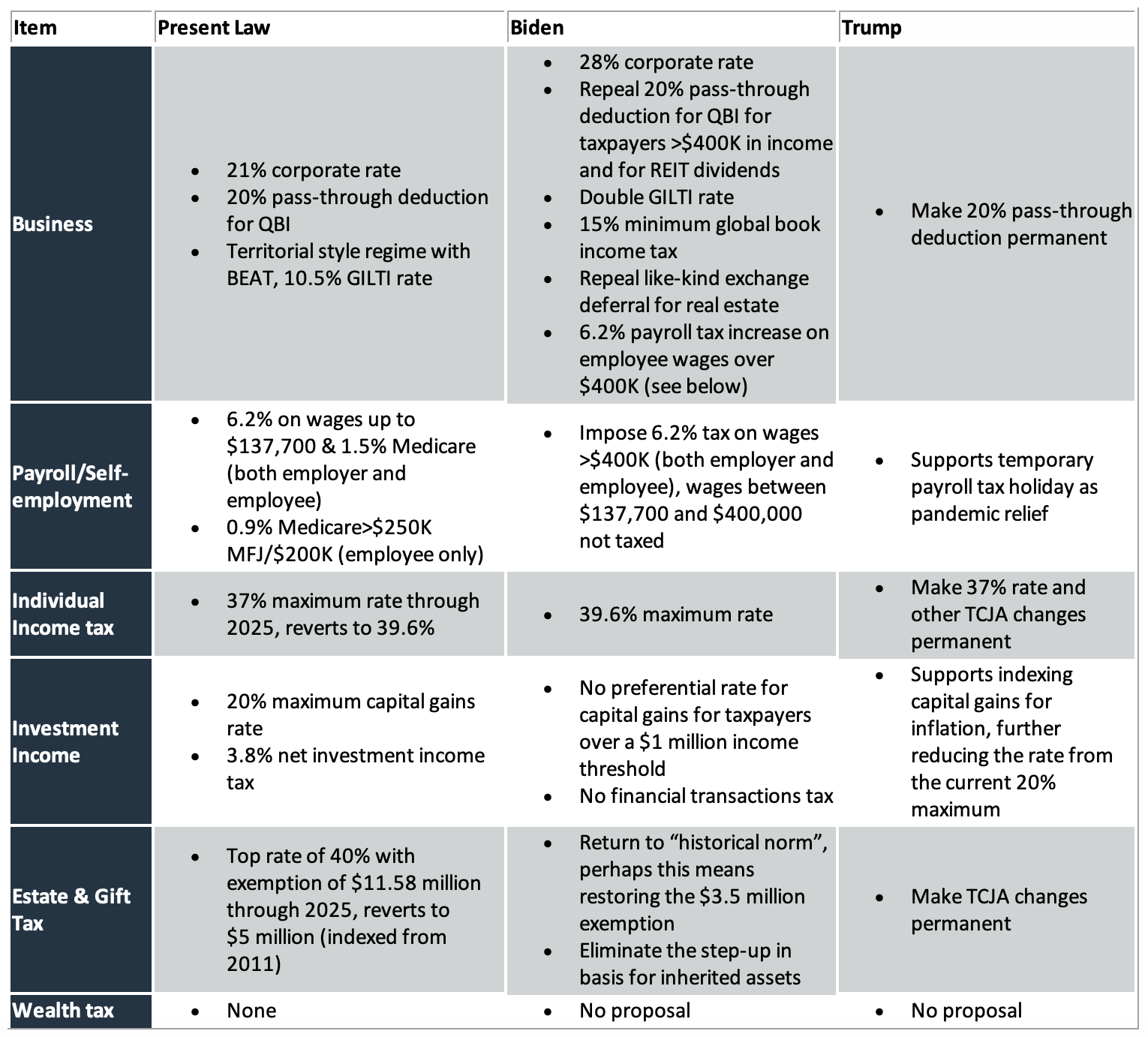

Joe Biden is the presumptive Democratic nominee after securing enough delegates for the Democratic Party’s nomination for the President of the United States. As a result, he’s in position to accept the nomination at the Democratic National Convention in August and compete against President Trump in November. Against the backdrop of the economic turmoil created by the COVID-19 pandemic and the enactment of Republican-only tax reform in 2017, tax policy will be a critical point of differentiation in the 2020 presidential race. Below is an analysis of the key tax law changes Biden is pitching to voters on the 2020 campaign trail.

Setting the stage for the Democratic party’s desire to implement major changes to tax policy was the enactment of the Tax Cuts and Jobs Act (TCJA) in 2017, which Democrats unanimously opposed. Democrats favor building a more progressive tax system, as explained in the recently released Biden-Sanders Unity Task Force Recommendations. The stated goal is to use taxes as a tool to reduce inequality and concentrations of wealth as well as to pay for investments in U.S. productivity and fund the ongoing needs of the government. This is in sharp contrast to President Trump, who’s campaigning on making the expiring provisions of the TCJA permanent.

Raising Tax Rates on Top Earners

Under the TCJA, individual income tax rates range from 10% to 37%. Biden would return the top rate to the pre-TCJA 39.6% and presumably would restore the state and local tax deduction for amounts above the $10,000 cap. Top earners in high-tax states may see a net income tax reduction. However, the payroll tax proposals would result in a significant tax increase for high earners and their employers.

Biden seeks to eliminate the Social Security tax exemption for wages and self-employment earnings above $400,000 (wages and earnings between $137,700 and $400,000 still wouldn’t be taxed, creating a donut-hole structure). The 12.4% Social Security tax is split evenly between the employer and the employee. Thus, this proposal would increase payroll taxes for high-income wage earners and their employers. Coupled with the income tax and Medicare surcharge, this would bring the top rate for employment income to 48.4%, before state and local taxes.

Investment Income

Capital gains are subject to a tax rate ranging from 0% to 20% depending on the taxpayer’s income. Capital gains, under the Biden plan, would be taxed at ordinary income rates for taxpayers with income over $1 million, thereby eliminating the rate preference for these taxpayers. Such income would also be subject to the 3.8% net investment income tax as it was enacted as part of the Affordable Care Act. The impact of this would be significant for high-income investors as well as founders and entrepreneurs who may experience a liquidity event after building value over a number of years. Biden hasn’t proposed changes to the qualified small business stock exclusion as of this time. Biden also hasn’t specifically voiced support for tighter carried interest restrictions, however, taxing capital gains at ordinary income rates for those over the $1 million threshold would limit the benefit of carried interest.

Estate and Gift Taxes

Under present law, heirs receive an increased basis or so-called “stepped-up basis” in inherited assets equal to the current fair market value (FMV). As a result, capital gains tax is based on the value of the asset at the time it’s inherited. Biden’s plan eliminates the step-up in basis for inherited assets. It’s not entirely clear whether the proposal would provide the heirs with a carryover basis or impose capital gains tax on the decedent for unrealized appreciation at the time of death, which was one of President Obama’s budget proposals. If heirs receive carryover basis, capital gains tax would be imposed on the heir based on the value of the asset from the time the original investment was made. The result would often lead to a significantly higher income tax liability for the heir should the inherited asset be sold. If the proposal is to tax unrealized gains of the decedent, the decedent’s estate would pay the tax, and presumably the heirs would take the assets at a FMV basis.

The TCJA increased the estate tax exemption threshold to its current level of $11.58 million per individual (indexed for inflation). While Biden hasn’t committed to supporting all recommendations, the Biden-Sanders Unity Task Force has recommended returning the estate tax regime to the “historical norm.” This could mean restoring the exemption threshold to the 2009 level of $3.5 million per individual, and it could portend an estate tax rate increase back to the 45% rate in effect in 2009. Biden hasn’t proposed a wealth tax regime, which was championed by the Sanders and Warren campaigns during the primary season.

Raising Corporate Tax Rates

The TCJA lowered the corporate tax rate to a flat 21%, down from a top tax rate of 35%. Biden’s plan would increase the corporate tax rate to 28%. He also favors imposing a minimum book tax equal to 15% of a company’s global financial statement profits. The tax would apply to any company with net book income in excess of $100 million in the United States that otherwise would pay zero or negative federal income taxes for the year. The amount of any minimum book tax due could be reduced by foreign tax credits or the carryover of prior year losses. For companies operating in the United States and abroad, Biden has proposed doubling the tax rate on global intangible low-taxed income to 21% (currently 10.5%).

The increases in corporate taxation could be quite significant as the TCJA contained base-broadening measures that would presumably stay in place while rates rise and further global minimum taxes are imposed. Investors should be mindful of the impact these changes would have on the value of their investments.

Elimination of Tax Benefit for Real Estate Investments

The TCJA previously repealed like-kind exchange treatment (Internal Revenue Code Section 1031) for personal property. The like-kind provision, after modification by the TCJA, allows investors to defer tax on gains from sales of real property by rolling the sales proceeds over into a subsequent real property purchase. Biden’s plan would go further and also repeal like-kind exchange treatment for real property for taxpayers with income over $400,000. In addition, Biden has proposed repealing the IRC Section 199A deduction special qualifying rules for real estate, which may be a reference to repealing the Section 199A deduction for qualified real estate investment trust dividends, the special rules for rental income from related parties or the safe harbor rules for rental activity that fails to rise to the level of a trade or business under IRC Section 162.

Financial Transactions Tax

Biden supports a financial transaction tax on trades of stocks, bonds and other financial instruments. However, unlike other Democratic candidates from the Democratic primaries, Biden hasn’t released the details of this plan.

The Takeaway

In these tumultuous times it’s difficult to predict what policy initiatives the winner of the 2020 presidential election is likely to pursue. However, given the backdrop of the economic devastation created by the COVID-19 pandemic and the enactment of a highly partisan tax reform measure in 2017, it seems certain that tax policy will take center stage. Should Democrats win the White House as well as the House and Senate, the enactment of tax changes in 2021 is highly likely. As tax changes aren’t typically retroactive, the changes likely wouldn’t be effective until 2022. Republicans in 2017 demonstrated how highly partisan tax legislation could be passed even with a slim majority in the Senate through a budget reconciliation process that bypasses the 60-vote filibuster threat. Democrats are floating whether the filibuster rule should be eliminated entirely. The tax changes on the table are sweeping in nature, and it’s never too early for clients to prepare.

Source: https://www.wealthmanagement.com/high-net-worth/biden-hits-campaign-trail-tax-policy-proposals?NL=WM-17a&Issue=WM-17a_20200805_WM-17a_317&sfvc4enews=42&cl=article_1&utm_rid=CPG09000014404492&utm_campaign=28345&utm_medium=email&elq2=a0e6fcf1cc35409cbc461d750608be10&oly_enc_id=3903B4406178G5X