The Estate, Legacy and Long-Term Care Planning Center of Western NY

Financial Advisor in Rochester, NY

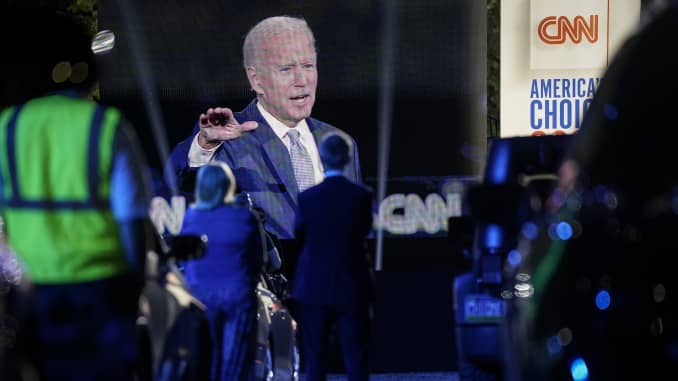

Here’s what Joe Biden’s tax proposals mean for American households

An overhaul of tax incentives for American families could be in the cards if Democratic candidate Joe Biden wins the White House.

In his tax plan, the former vice president called for an expansion of the tax credits families currently receive to help offset the cost of raising children.

More from Smart Tax Planning:

These 7 states let you write off work-from-home expenses

What being your own boss can mean for your taxes

These tax issues arise if you’ll work from home permanently

That tab includes housing, food and childcare costs — consider that families in the northeastern part of the U.S. spend an average of $26,102 on childcare annually, according to Child Care Aware of America.

Here are three tax incentives Biden has pitched to help manage those costs.

Expanding the child tax credit

Currently, families with qualifying children under age 17 may be eligible to claim a child tax credit of up to $2,000 per kid.

Biden is proposing an increase of the child tax credit to $3,000 for kids 17 or younger, plus a $600 bonus credit for kids under age 6, according to an analysis by the Tax Foundation.

The expansion would kick in in 2021 and for “as long as economic conditions require,” according to Biden’s website.

There’s a sweetener for low-income households here: Biden is calling to make this tax credit fully refundable. This means taxpayers receive a refund in their pocket, even if the credit exceeds the amount that they owe in tax

This matters because right now the child tax credit is only partially refundable — that is, a taxpayer can only get back up to $1,400 refunded even if they owe no tax.

Since families can only collect on the child tax credit once a year, the former vice president has also proposed allowing the option of spreading the credit over the course of the year. This way families get monthly payments rather than one windfall in April at tax time.

“Currently, you get the whole credit calculated once at tax payment,” said Garrett Watson, senior policy analyst at the Tax Foundation. “Here, you’d get a prorated amount of credit each month, which helps you smooth out the consumption of the credit for each year.”

Overhaul of child and dependent care credit

Depending on where you live, the cost of childcare in a year could be on par the cost of higher education.

Indeed, there are 30 states in which the cost of care for an infant exceeds annual in-state college tuition and fees, according to Child Care Aware of America.

The child and dependent care tax credit helps families recoup some of those expenses.

Depending on your income, this nonrefundable credit can be valued at up to $1,050 per child under age 13 or $2,100 for two or more kids under age 13.

Biden is calling for an update to the way the credit is calculated, which could increase its value to a maximum of $4,000 for one child or $8,000 for two or more children, according to the Committee for a Responsible Federal Budget.

The former vice president is also calling to make this a refundable credit.

“Middle-income families hear all the time about how they’re getting hammered on childcare expenses,” said Elaine Maag, principal research associate in the Urban-Brookings Tax Policy Center.

“This puts things more in line with what people are paying, versus existing limits.”

A new caregiver’s credit

Finally, the former vice president is proposing a $5,000 tax credit to help families cover the cost of informal care for aging relatives.

“Maybe I’m purchasing equipment for my mother who lives across the country, or I’m paying someone to check in on her,” said Maag at the Tax Policy Center.

Expect to do a little bit of bookkeeping if you wind up claiming this credit.

Families will likely need to indicate who they’re caring for and crunch the numbers on what they’ve spent — the same way parents do when they hash out the child and dependent care credit.

“You will indicate how much you paid for that list of items and calculate the credit based on those expenses,” Maag said.

Source: https://www.cnbc.com/2020/10/08/heres-what-joe-bidens-tax-proposals-mean-for-american-households.html