The Estate, Legacy and Long-Term Care Planning Center of Western NY

Financial Advisor in Rochester, NY

New 2021 IRS Income Tax Brackets And Phaseouts

Each year, the Internal Revenue Service (IRS) makes rounded inflationary adjustments to the federal income tax brackets and the income phase-outs for various tax deductions and tax credits.

Although IRS Publication 17, Your Federal Income Tax, and IRS Publication 970, Tax Benefits for Education, won’t be updated until 2021, the IRS usually publishes the updated numbers in a Revenue Procedure in late October or early November.

Tax Brackets

The tax-rate tables include seven tax brackets, with the following income ranges.

The Kiddie Tax thresholds are unchanged at $1,100 and $2,200.

The refundable portion of the Child Tax Credit remains unchanged at $1,400.

The maximum Earned Income Tax Credit is $543 for no children, $3,618 for one child, $5,980 for two children and $6,728 for three or more children.

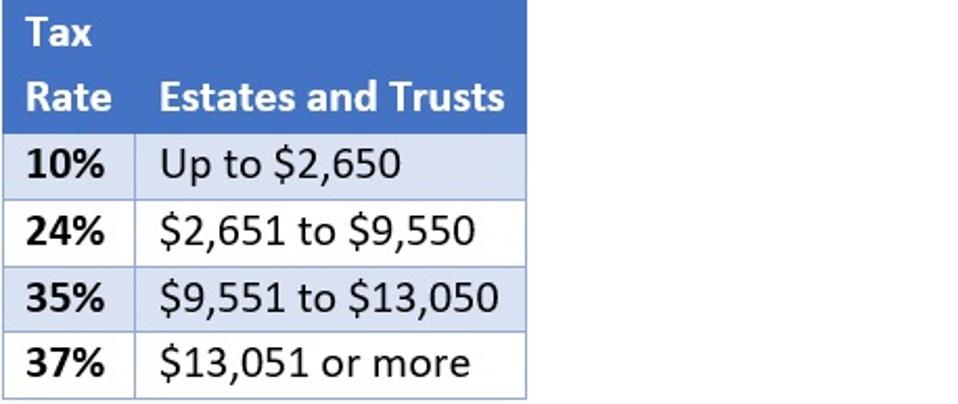

The tax rates for estates and trusts have four brackets.

The standard deduction has increased slightly.

The Alternative Minimum Tax (AMT) exemption is $73,600.

The income limit for certain capital gains tax rates has increased.

Income Phaseouts

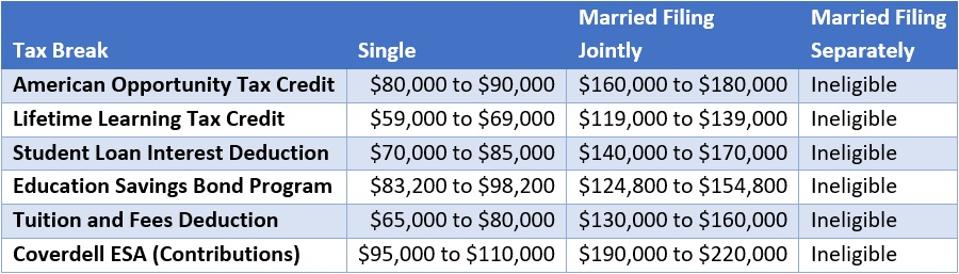

There are several different income phaseouts for education tax benefits.

Income Exclusions

Annual Gift Tax Exclusion: $15,000 (unchanged)

Lifetime Estate and Gift Tax Exclusion: $11.7 million

Foreign Income Exclusion: $108,700

Retirement Plan Contribution Limits

Roth IRA contribution limits remain at $6,000, with an additional $1,000 catch-up contribution limit for workers age 50 and older. The income phaseout on contributions is $125,000 to $140,000 (single and head of household), $198,000 to $208,000 (married filing jointly) and $0 to $10,000 (married filing separately).

The contribution limits for 401(k), 403(b) and 457 plans are unchanged at $19,500, with an additional $6,500 catch-up contribution limit for workers age 50 and older.

The income limit for the Saver’s Credit is $33,000 (single and married filing separately), $66,000 (married filing jointly) and $49,500 (head of household).

Source: https://www.forbes.com/sites/danielcassady/2020/11/10/report-pope-john-paul-ii-was-aware-of-sexual-misconduct-allegations-before-promoting-ex-cardinal-theodore-mccarrick-to-archbishop/?sh=291dfdaf26ad