How To Use Life Insurance To Pay For Long-Term Care There’s a good chance you’ll need long-term care as you age. But if you’re like many Americans, you likely don’t have a plan to pay for this sort of care. Although about half of adults turning 65 today will develop a disability that is serious …

Articles

Eight Estate Planning Strategies In A COVID-19 World

Eight Estate Planning Strategies In A COVID-19 WorldThe reality of COVID-19 has forced many individuals to address the “what if” scenarios that were previously unthinkable, or at least the situations that no one ever wants to talk about or deal with. Most of us have fortunately never dealt with …

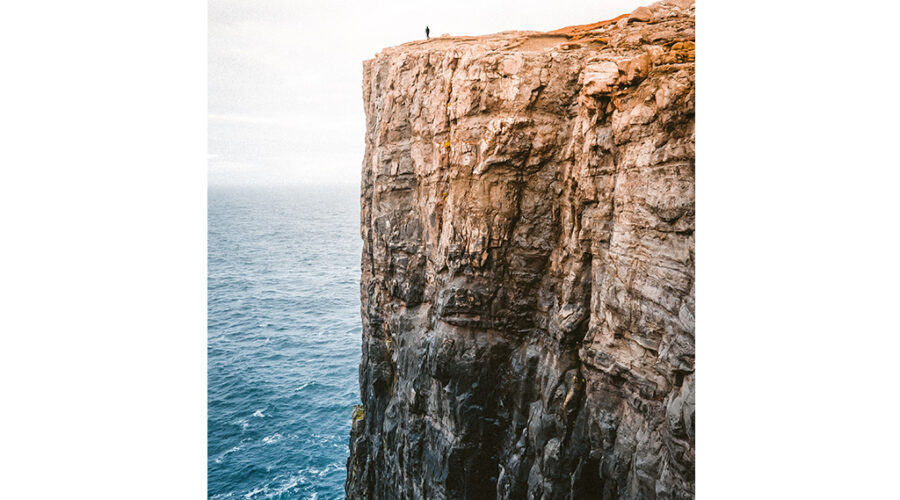

New York Estate Tax and Its Dreaded “Cliff”

New York Estate Tax and Its Dreaded “Cliff” For deaths occurring after January 1, 2020, New York will tax estates valued at more than $5,850,000. Even if your estate is not large enough to owe federal estate tax (currently, the exemption amount is $11,580,000 for an individual), you may still owe …

Reverse Mortgages: How They Work And Who They’re Good For

Reverse Mortgages: How They Work And Who They’re Good For A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. By borrowing against their equity, seniors get access to cash to pay for cost-of-living expenses late in …

Life Estate Deeds Advantages & Disadvantages

Life Estate Deeds Advantages & Disadvantages Today, it is possible to re-title the ownership of many assets by adding a beneficiary. When the asset is real property, for example, your house, this occurs through the use of a life estate deed. However, life estate deeds are not a fix-all. They …