Great news, our live workshops are back and follow all COVID safety guidelines.

You can also watch this informative video then schedule a free 30-minute one-on-one consultation.

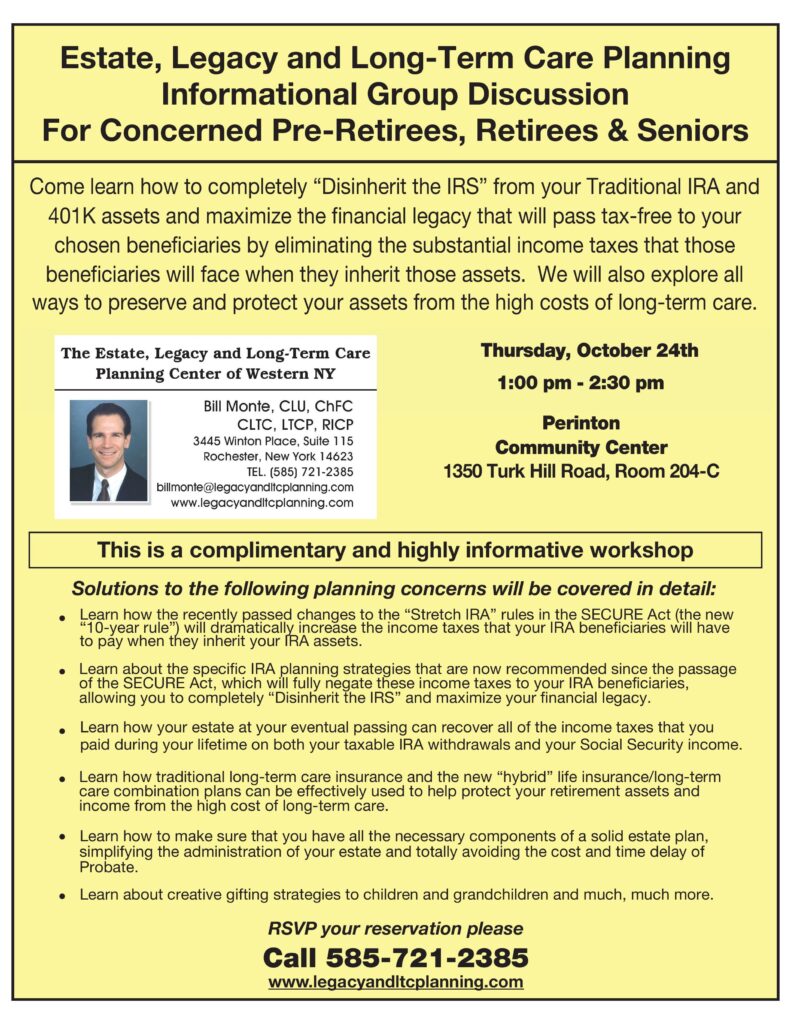

Upcoming Workshops

I’m passionate about thoroughly educating concerned pre-retired professionals as well as those already retired on all of the Estate, Legacy and Long-Term Care Planning options available to them. To that end, I host free monthly informational workshops around the Rochester, New York area at the Community Centers in Perinton, Brighton and Webster.

During these informal group discussions, I will cover solutions to common concerns about planning. You will learn how

- To make sure your chosen beneficiaries don’t pay one dime of taxes (Income, Estate or Capital Gains) when they inherit your taxable Traditional IRA, 401k and 403b accounts so that are able to maximize what is passed on to them.

- Upon your passing, your estate can fully recoup all the income taxes that you paid during your lifetime on both your taxable IRA withdrawals and your Social Security income.

- The recently passed SECURE Act dramatically changed the Stretch IRA rules (new “10 year rule”). These changes substantially increase the amount of Federal and State income taxes that your beneficiaries (i.e. children/grandchildren) will have to pay when they ultimately inherit your taxable Traditional IRA, 401k and 403b accounts.

- Traditional long-term care insurance (New York State Partnership Plan) as well as the popular hybrid long-term care combination plans can be used to fully protect all of your retirement assets from the high cost of long-term care in our area, particularly nursing home care.

- To ensure you have all the necessary components of a solid estate plan, simplifying the administration of your estate for your executor and avoiding the cost and delay of going through probate.

- And much, much more.

To register and reserve your seat(s), just click on the individual flyer above for the location you want to attend. I look forward to seeing you there and putting my teacher’s cap on for you!